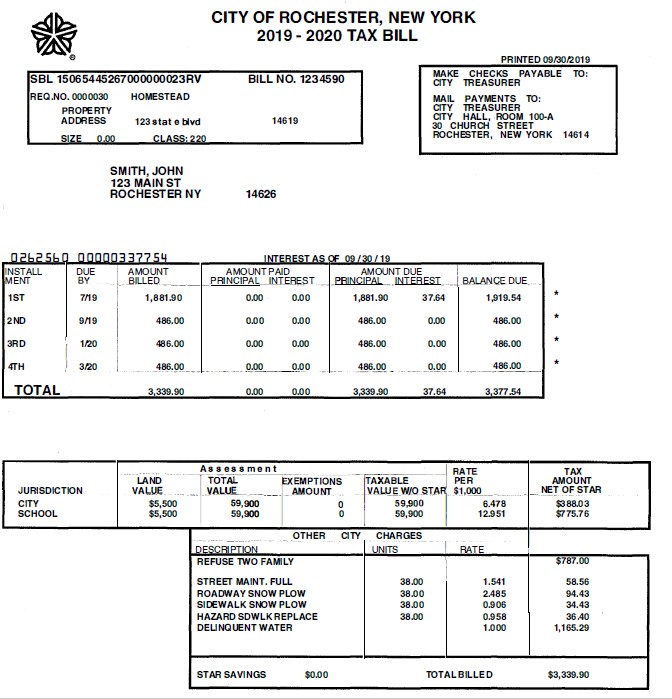

The City of Rochester levies property taxes on behalf of itself and the Rochester City School District. Property tax bills are mailed each July to all property owners who do not have escrow arrangements with their mortgagee. City tax bills are split into four installment deadlines. The four installment deadlines are: July 31, September 30, January 31, and March 31. If your balance for each installment has not been paid by the installment deadline, interest penalties will begin to accrue at 1% interest per month. If the installment deadline falls on a weekend, the deadline for payment is the following Monday.

The City of Rochester levies property taxes on behalf of itself and the Rochester City School District. Property tax bills are mailed each July to all property owners who do not have escrow arrangements with their mortgagee. City tax bills are split into four installment deadlines. The four installment deadlines are: July 31, September 30, January 31, and March 31. If your balance for each installment has not been paid by the installment deadline, interest penalties will begin to accrue at 1% interest per month. If the installment deadline falls on a weekend, the deadline for payment is the following Monday.

Copies of City tax bills can be found here: My Property Information

A brief description of common add to tax charges can be found here: Add to Tax charges

Tax rate information can be found here: Tax Rates

Per New York State Real Property Tax Law Section 922, property owners are responsible for paying their taxes on time, regardless of whether or not they have received a copy of their bill.

City of Rochester tax bills do not include Monroe County charges. Monroe County tax bill information can be found here: Monroe County Tax Information